Right now, there’s a lot going on in the DC Metro Real Estate Market, but we also want to acknowledge there’s so much more happening across the world right now. So many of the families in our community are significantly impacted by the conflict between Palestine and Israel, and as these events continue developing, we are committed to growing and learning about how we can better serve and support our neighbors during this time. Our work in real estate is inextricably tied to the health and well-being of our clients and community, so we want to ensure our market update this month is framed within this context.

With this in mind, let’s talk about what’s going on in today’s market.

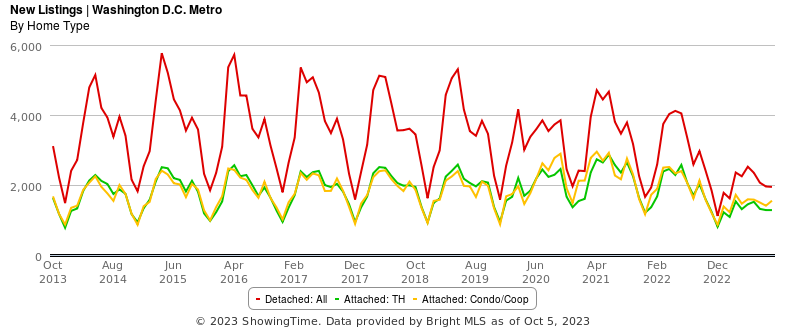

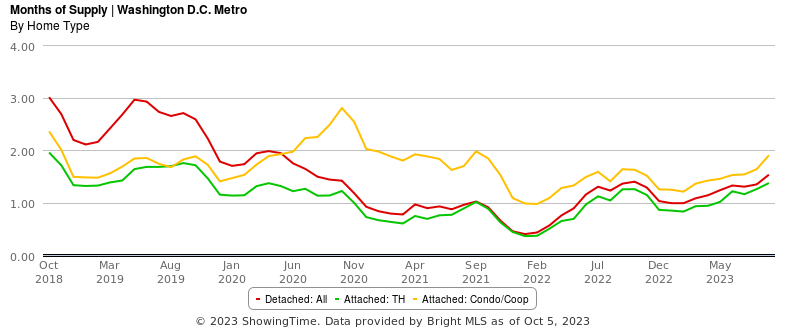

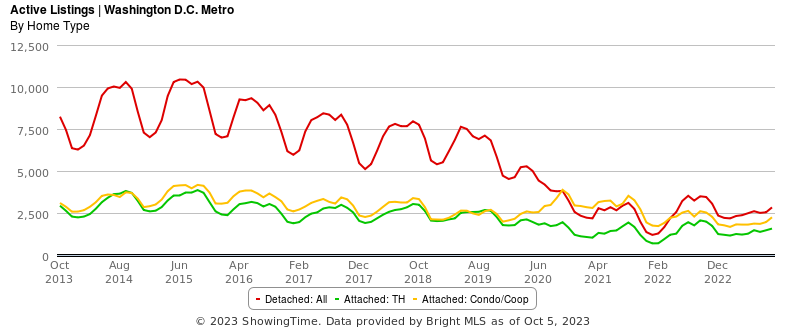

The number of homes for sale remains low in the DC area across all home types compared to previous years. There was a slight uptick in listings in September, which is consistent with normal seasonality–we should see listings continue to rise in October and then decrease through November to February, when they should start to rise again with the Spring market.

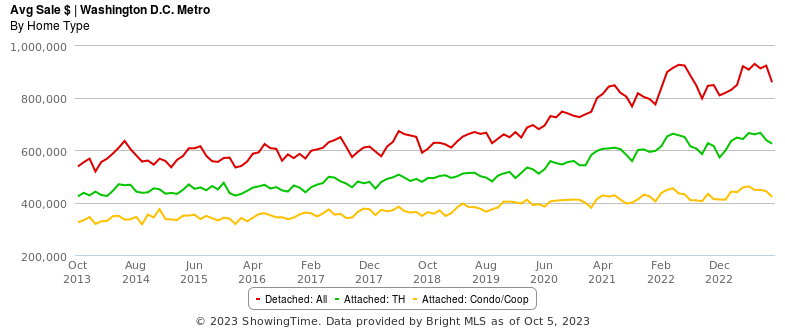

We did see the average sales price drop last month, which is again consistent with the seasonal slowdown of the fall and winter months. While home prices are cooling down after a summer of historically high prices, they are still about 6% higher than this time last year across all home types.

We need more listings, however the number of new listings in September has remained relatively flat. We typically expect more new listings during this time of year, so inventory remains tight. Despite the lack of new listings, we just saw that active listings were picking up a little, which is a very small indication of perhaps a cooling market.

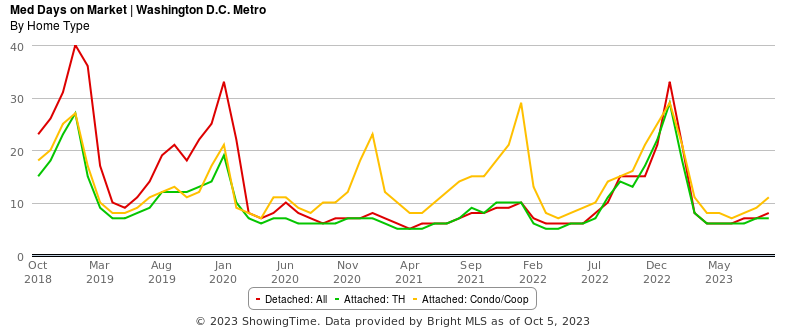

As a seller it’s still great for you though. The Median Days on the Market for detached homes is 8 days, which is still nearly 50% lower than what the Median Days on the Market was last year at this time. Homes are still selling very quickly.

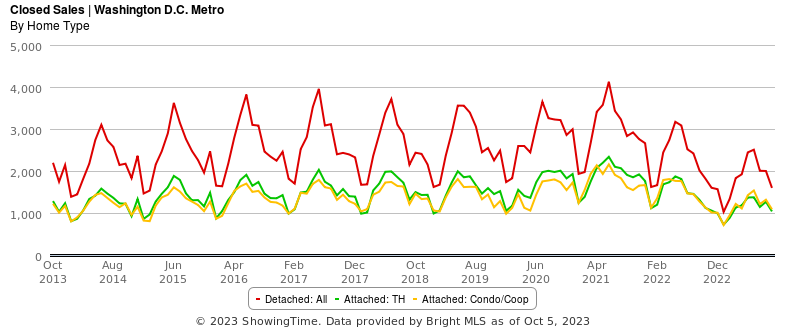

As predicted, we saw a drop in the number of closed sales in September, as low inventory left buyers with few options, leading many to delay their purchase decisions. Across all home types, the number of closed sales is down 19% compared to this time last year.

With the number of active listings increasing while new listings stay consistent, inventory in the housing market is creeping back up, especially in the condo market. Right now, we’re seeing about 1.5 months of supply for single family homes and townhomes, while months of supply for condos is close to 2 months. Remember three months is a stable market so under three months continues to keep us in a sellers market for now.

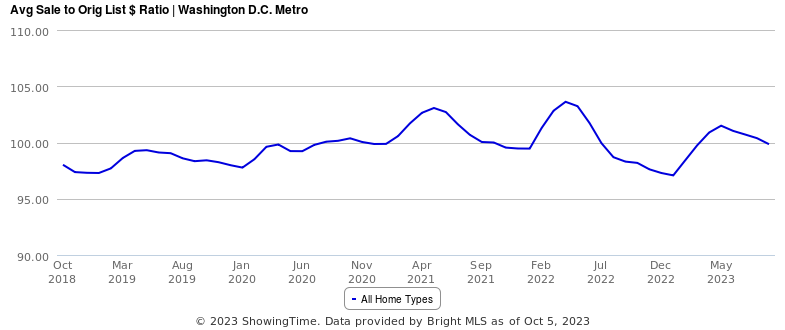

For the first time since March, the average sales price to original list price ratio dipped below 100%, meaning that on average, homes are selling at or slightly below the listing price.

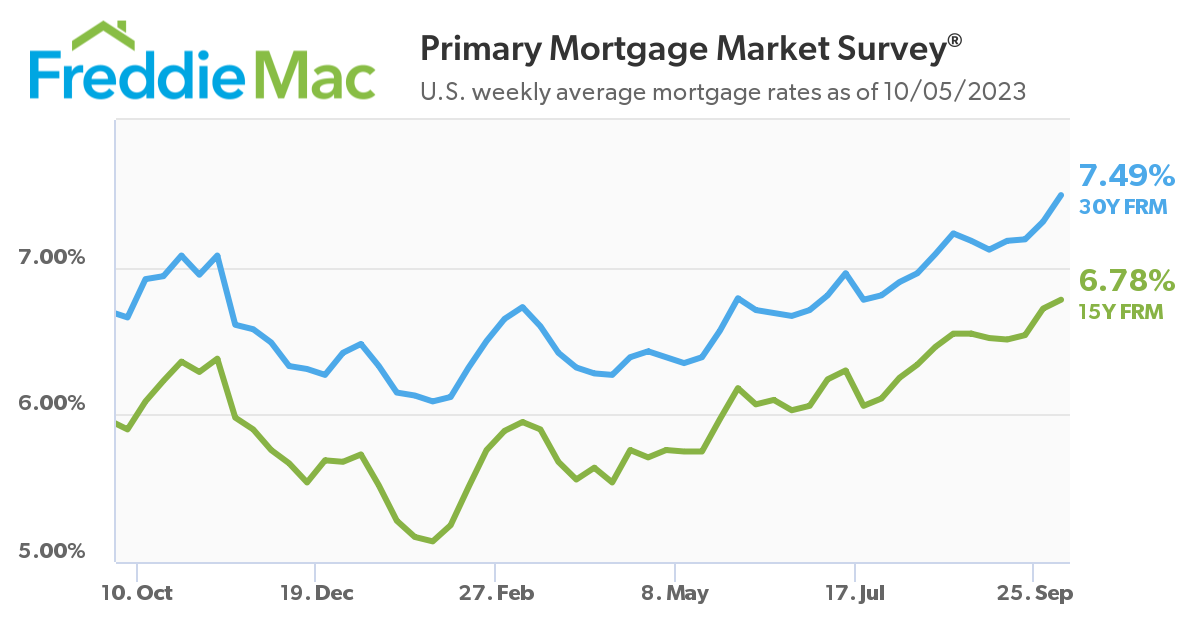

Mortgage rates have continued their upward trajectory to around 7.5%, however we have seen some interesting programs out there putting rates back in the 6’s.

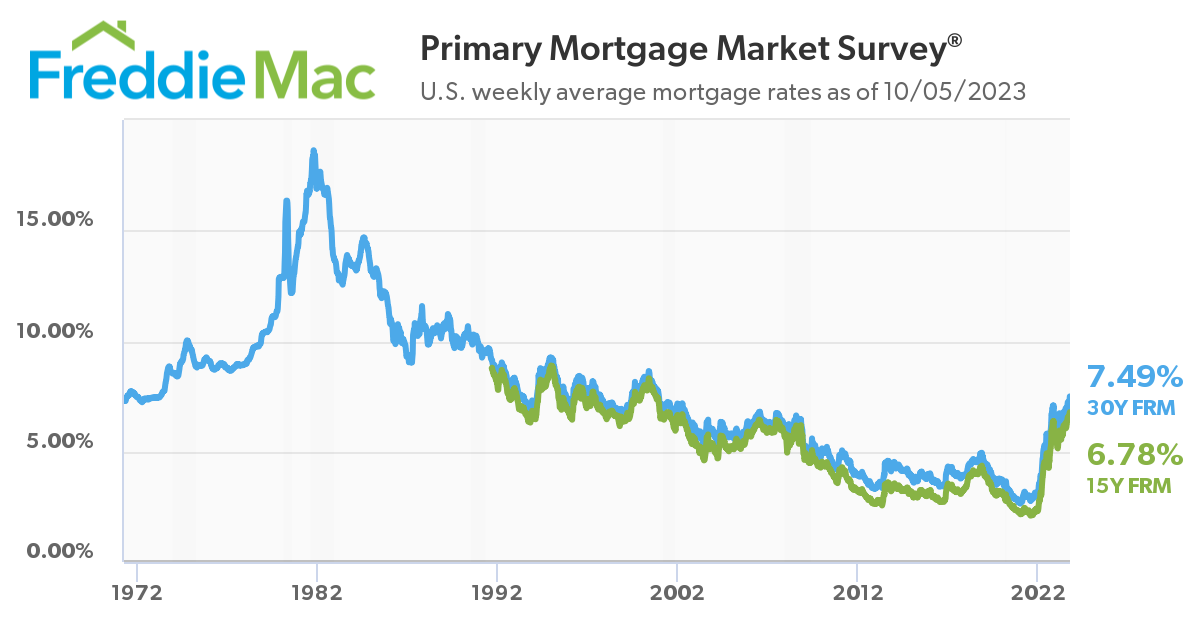

If we’re just looking at this past year, the outlook seems grim. But if we zoom out and take a look at mortgage rates over all time when our parents and their parents were buying homes, it tells a different story. Now homes were definitely cheaper back then, which is of course an important factor, but there’s nothing to indicate that homes aren’t going to continually appreciate in value in the coming years.

In fact, home prices are expected to rise between 2-4% each of the next 5 years according the a home price expectations survey made of up 100 of the top economists in the country.

With all this in mind, here are our final thoughts for buyers sellers and investors.

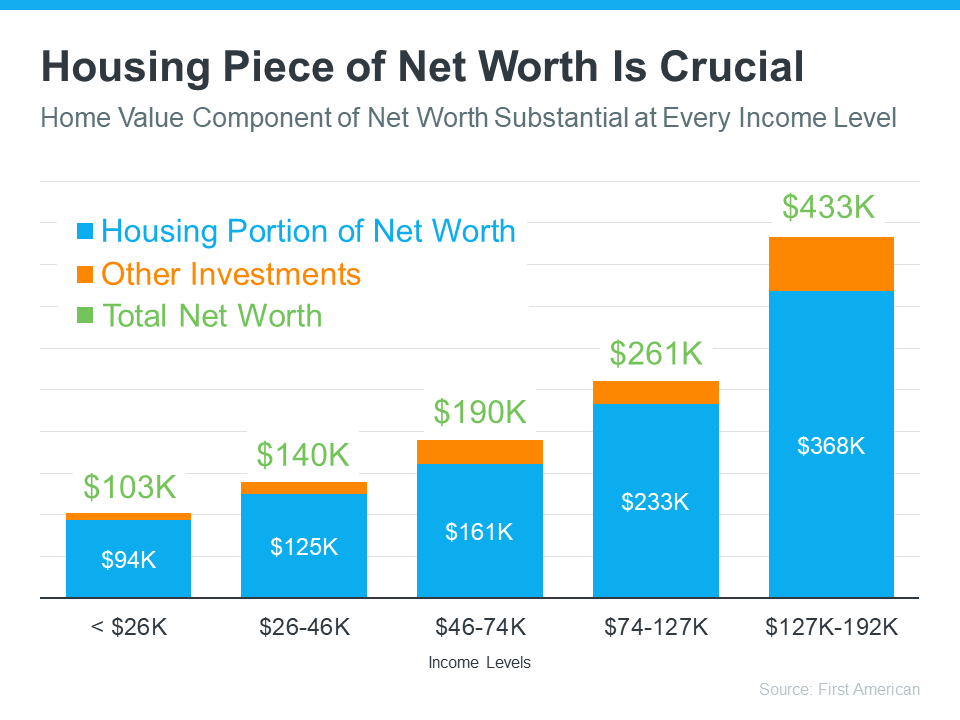

Owning real estate remains one of the best investments there is and is statistically the highest portion of most people’s net worth. Timing the market is very tough, and the reality is that when you get in doesn’t matter as much as how long you stay in. If you own a home for 30 years, you will pay it off and it will likely be one of the most valuable assets you own, while increasing in value around 4% a year.

So if you are a buyer:

- Seasonal factors and increased inventory are pushing home prices downward. While interest rates are high, zooming out to see where we stand in relation to past decades can be a clear indicator that buying a home is still a great option to begin building equity and growing your net worth, knowing that you can always refinance if rates drop.

- The average sales price to original list price has dipped below 100%, meaning that the market is maybe cooling off and sellers are accepting lower offers on average than in past months. Now could be a good time to focus your search and consider finding your dream home!

If you are a seller:

- While inventory is beginning to increase in today’s market, it’s still historically low compared to past years, while demand remains high. Now is a great time to evaluate the equity you have in your home, and to see whether it’s advantageous for you to move into a space that may better fit your needs, knowing that you may be less tied to fluctuating interest rates with the equity you already have in your home.

If you are an investor:

- Cash is king and demand is high. If you can find a good value, it’s a great time to buy and rent or fix and flip real estate. While interest rates remain high, more buyers have less buying power and may be looking for good options to rent.

As international conflicts and market factors continue in the world and in our communities, we know that life doesn’t stop for you and your family. We are always here for you as trusted advisors, and appreciate every opportunity we have to serve you in this all-important decision of owning real estate. Now more than ever, please let us know how we can support you. We’re grateful for you, we appreciate you, and we want to serve you and the people you care about.