Hi everyone! Welcome to the January Housing Report for the DC Metro area. A new year means new opportunities, whether you’re buying, selling, or investing. Our team is here to help you every step of the way.

Today, we’ll cover key housing trends to help you make confident decisions in 2025, plus some exciting client events you won’t want to miss—including a Valentine’s Day Date Night option!

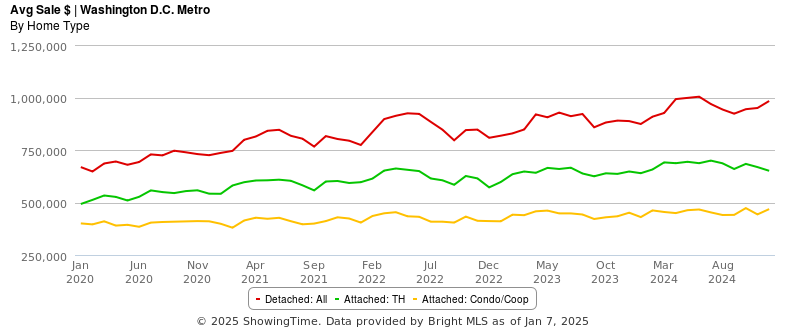

Overall, housing prices continue to rise showing the strength of the DC economy and housing market. The biggest gains are for single-family homes, with townhouses and condos.

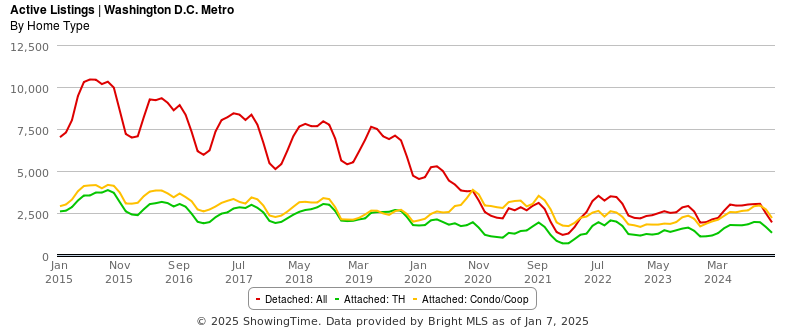

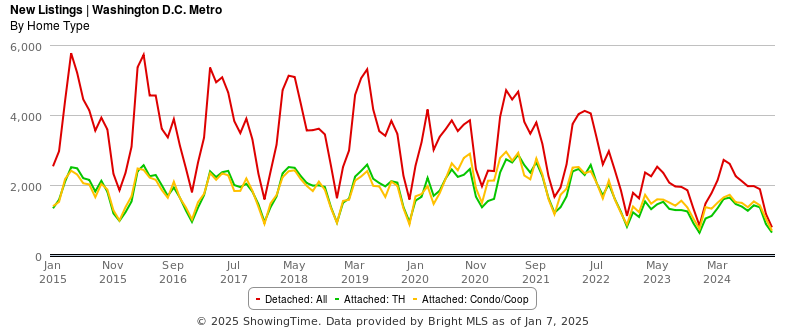

Good news for buyers—inventory has improved slightly year-over-year! While it’s still low compared to historical averages, there are more options available now than last year.

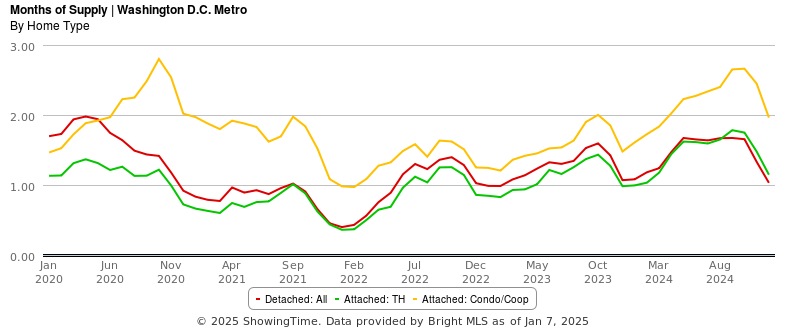

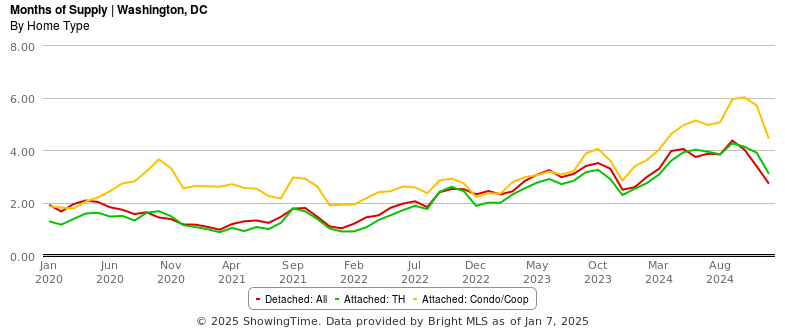

The months of supply metric for the entire DC metro area, which is the greatest general indicator of market strength, remains below the three-month threshold for single-family homes and townhouses, underscoring a seller’s market.

We have been keeping an eye on condos in DC proper, which had reached a six-month supply, suggesting a shift towards a more balanced or even buyer-favorable market in this segment. The good news for sellers is that we saw that drop back down to 4.5 months in December. We will continue to keep an eye on the DC condo market. Hopefully, the worst is behind us.

New listings have stayed low, especially for single-family homes, which is keeping inventory tight and prices stable. That said, many areas have seen year-over-year improvements, which is great news for buyers.

Let’s talk about what today’s market means for buyers and sellers. Interest rates are higher than they’ve been in recent years, which directly impacts buyers by increasing monthly mortgage payments. Why are rates rising? It comes down to the economy. The government aims for steady growth of 2-4% annually. When the economy slows or shrinks, they lower rates to encourage borrowing and spending, stimulating growth. On the flip side, too much money in the economy leads to inflation—like rising home prices when demand outpaces supply.

To combat inflation, the government raises interest rates, which slows borrowing. While today’s rates might feel high compared to five years ago, they’re actually near the historical average and far lower than the peaks of the 70s and 80s.

So, why are rates high now? During COVID, significant government stimulus added money to the economy to avoid a deep recession. With a strong recovery and extra cash in circulation, inflation followed.

What does this mean for housing? The spring market is already heating up. We’ve seen the same home sell for $100,000 more than it did a year ago. Inventory under $1.5M remains tight, so it’s a great time to sell. For buyers, competition is strong—some may need to adjust expectations and consider smaller options.

The silver lining? The economy is robust, employment is solid, demand remains high, and with more people returning to in-person work, real estate continues to be a valuable investment.

Now for some fun!

First, our Valentine’s Date Night. PRE clients, check out this month’s market update email newsletter for an invite to go ice skating at Reston Town Center.

Second is our Valentine’s Day Dinner raffle. We have reserved a table for 2 on Valentine’s evening at Randy’s Steakhouse in Tyson’s and are providing a $250 gift card to the winner. All you have to do to enter is leave us a review here and then send us an email at [email protected] to let us know.

Last, Join us March 1st at Wildfire in Tysons to learn how to navigate the 2025 market in a relaxed setting.

That’s it for this month! Buying or selling a home is a major decision, and we’re here to guide you and your loved ones every step of the way. Let us know how we can help you make the best real estate decisions for your future.