Happy April! You may have heard there’s a lot in the news about real estate right now, so we want to start off by briefly addressing the recent lawsuit against the National Association of Realtors. At the end of the day, while there may be some upcoming changes to how Realtors receive fees for services, there is still a lot to be determined before we even know what the new rules will be, and candidly, it’s possible it could take a long time to figure it out. As soon as we know, we’ll keep you posted, but in the meantime, you can be confident that our quality, level of service, and desire to prioritize what’s best for you isn’t going to change. Buying a home is one of the largest personal and financial decisions of your life, and we want to walk alongside you as your trusted advisor to help you make the best decision. Now, let’s talk about the DC Metro Area real estate market.

I want to start by highlighting the big difference between what’s happening in Washington, D.C., proper, and its suburbs of Northern Virginia and Maryland.

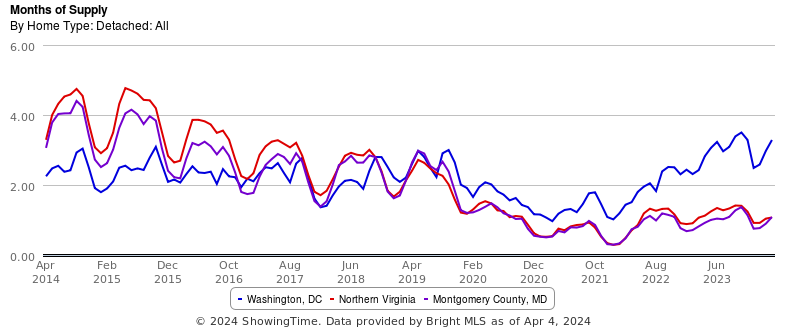

Currently, we have 1 month’s worth of inventory in Northern Virginia and Montgomery County, which is very low, but we have climbed above 3 months in DC. Below three months is a seller’s market when prices typically rise; at 3 months, prices stabilize, and above 4 months, prices start to fall. So, in the district, demand is stable but could turn into a buyer’s market if this trajectory continues. This is contrary to the suburbs, where it remains a strong seller’s market.

For the rest of this video, we are going to focus on the suburbs of DC because it’s where most of the activity is happening, but if you are looking to buy or sell in the District, give us a call—you may have to be more thoughtful about your next steps!

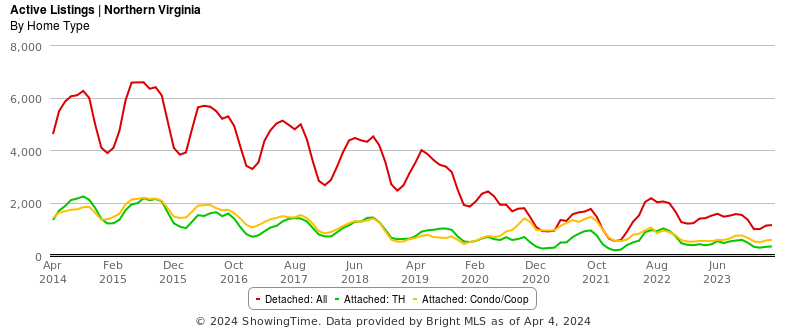

So let’s look at the Northern Virginia suburbs. Right now, we’re seeing our seasonal increase in active listings, which is great news for buyers. However, inventory is still low compared to our historical averages for this time of year.

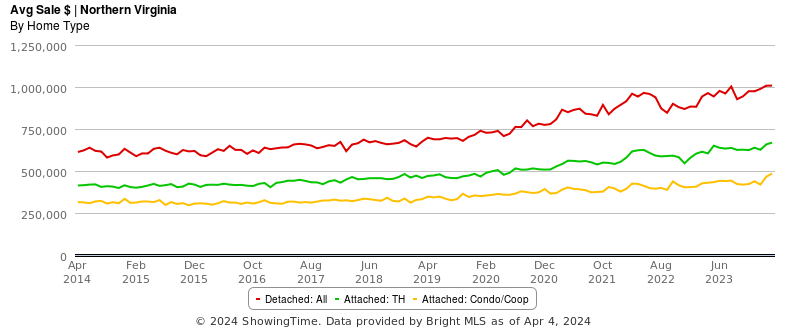

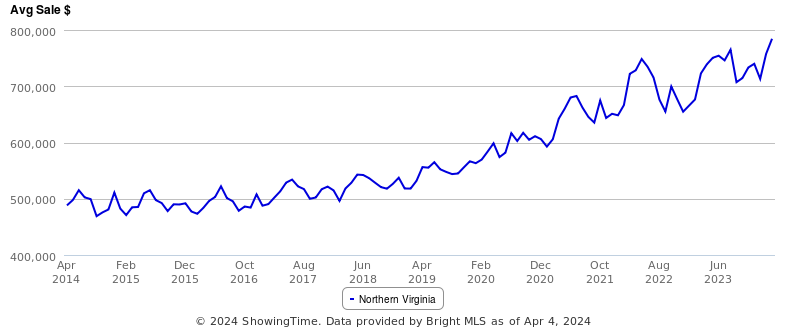

Low inventory continues to cause prices to rise across all home types. In fact, we closed last month with the highest average sales price in the last ten years and continue to see multiple offers on the best properties.

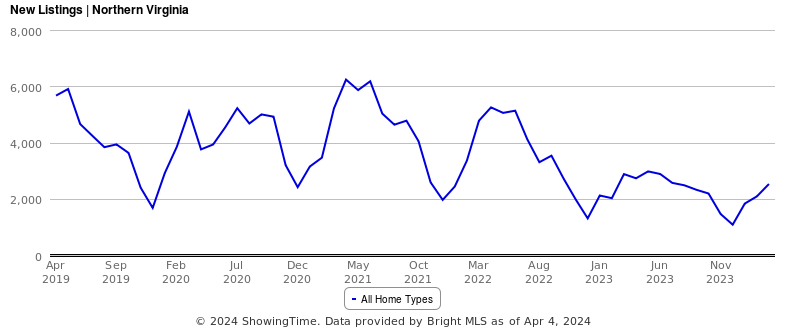

While the number of new homes coming on the market has trended upward into the Spring, it’s still lower than normal for this time of year–down about 50% from the average in March over the past decade.

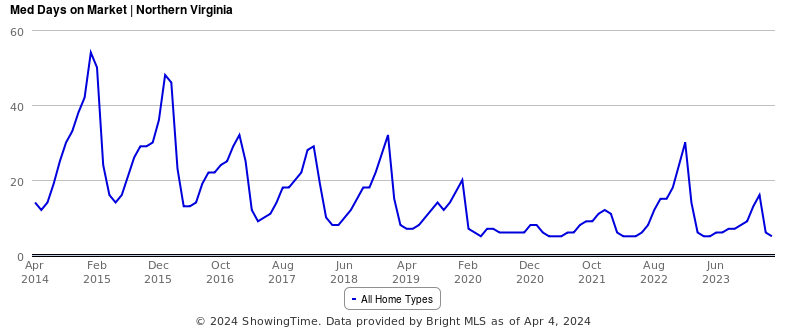

The increased demand in the market is illustrated again by the Median Days on the Market, which has dropped significantly across all home types and is now at 5 days! That’s right, in Northern Virginia, homes are typically on the market for ONLY FIVE DAYS!

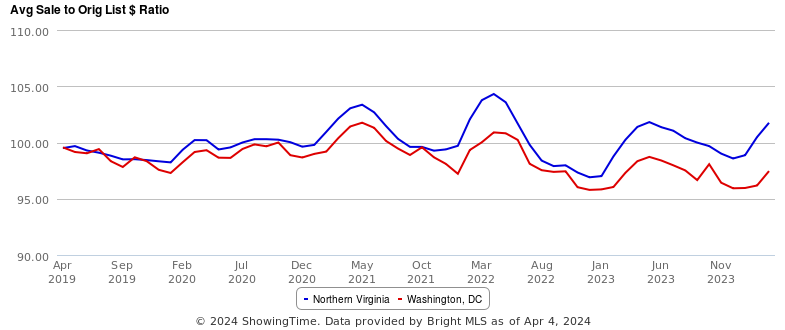

The average sales price to original list price ratio has increased in Northern Virginia to 101.8% of the asking price, while DC proper is around 96%. This further demonstrates the strong competition in the suburbs, versus the softening of the market in the District.

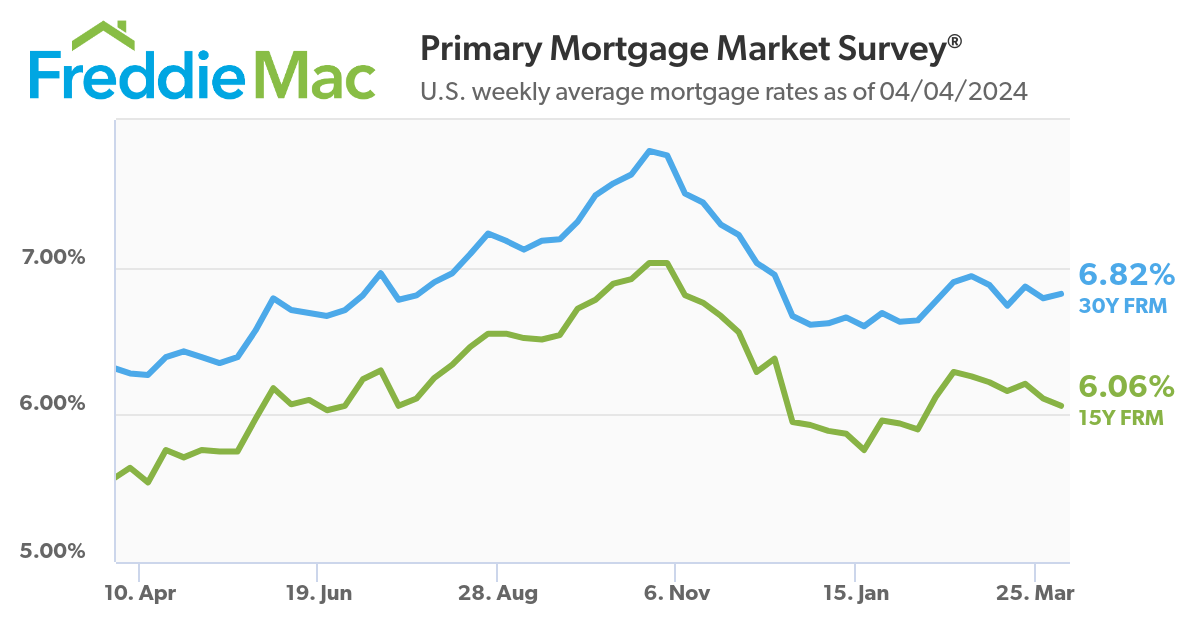

Interest rates have held steady recently, as we still sit below the 7.75% high of last year. While rates may seem high compared to the last few years, it seems like buyers are seeing this as the “new normal,” as demand and sales prices have continued to pick up drastically.

So what does it all mean?

If you are a buyer….

- Demand is strong, supply is low, and houses are moving fast (except in DC proper). If you’re in the process of buying, you may need to be prepared to see properties fast and make strong offers. I strongly recommend working with an experienced Realtor, especially if you aren’t going to be able to have many contingencies when you make an offer.

- As a buyer, you may consider waiting to buy, which is a reasonable thought. The challenge is with the strong demand and low supply, when will the market change?

- Looking back 10 years ago, the average sales price in Northern Virginia was $488,000 and now it’s $784,000 for all home types, including condos. In McLean, VA, the average single family home is above $2,000,000 right now.

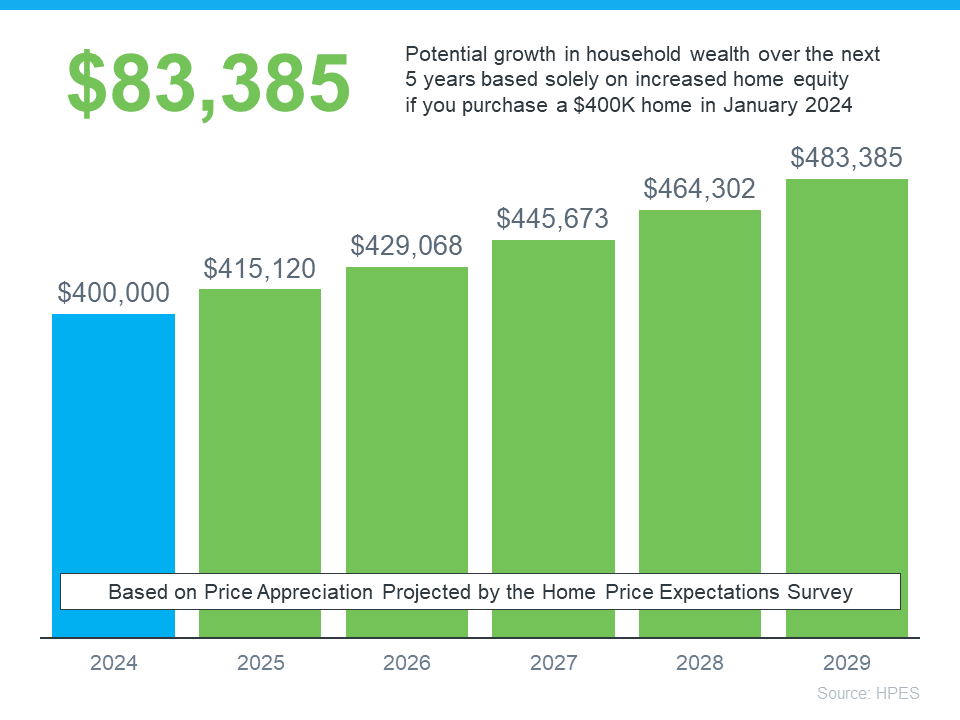

- Even with today’s home prices, if you were to buy a $400,000 starter home right now, experts project the property value will rise about $80,000 in home equity 5 years from now. For a million dollar home, that’s $200,000. Now there are no guarantees and markets change, but if you are worried about the risk of losing money, I believe it’s higher if you wait to buy. That’s just my opinion. If you or someone you know is considering buying a home for the first time but aren’t sure it’s financially wise, give us a call! We are always looking out for our clients and are happy to be honest about whether it makes sense for you to begin your homeowning journey now, or to wait until later. We’ll talk about the pros and cons.

If you are a seller….

- If you are in DC, the tide has shifted and you may need to be more flexible and patient. In the suburbs, there is strong demand for your home! With average sales prices for homes at 10-year highs, now may be a good time to evaluate whether your home is meeting your needs. If not, now may be a great time to get the most value for your home with the least amount of hassle and the quickest sale.

No matter where you are in your home buying or selling journey, we are here for you. We want to always be known as your trusted advisors, so if there’s anything we can do for you, or anyone you care about looking to buy or sell a home, please give us a call! We’d be happy to talk about your needs and put you in the best possible situation in the future.