Hey friends, welcome to our August 2024 Market Update! We hope you enjoyed a wonderful summer and we look forward to getting back into the swing of things this fall! There are some really encouraging signs in the local real estate market, so let’s jump right in and break down what we’re seeing.

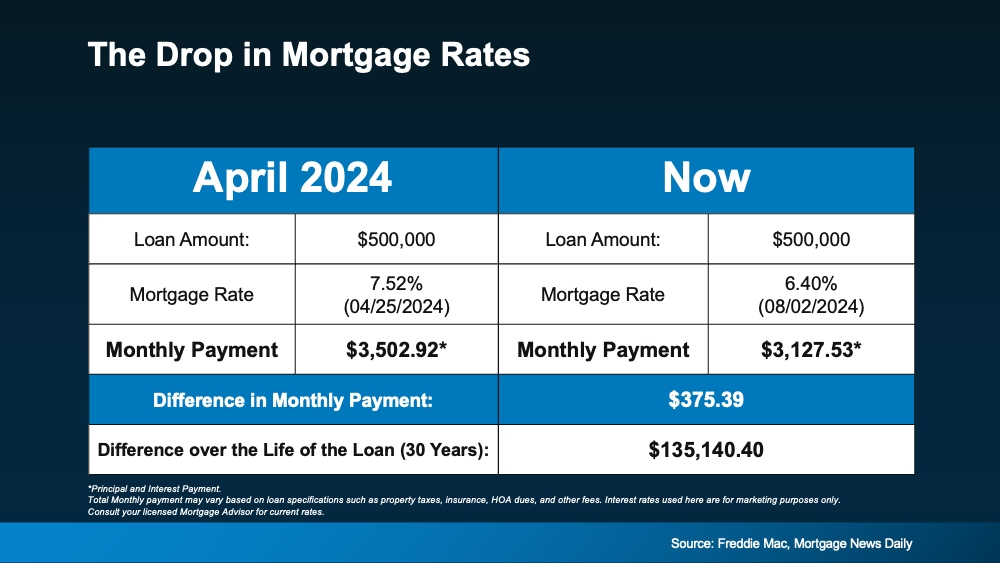

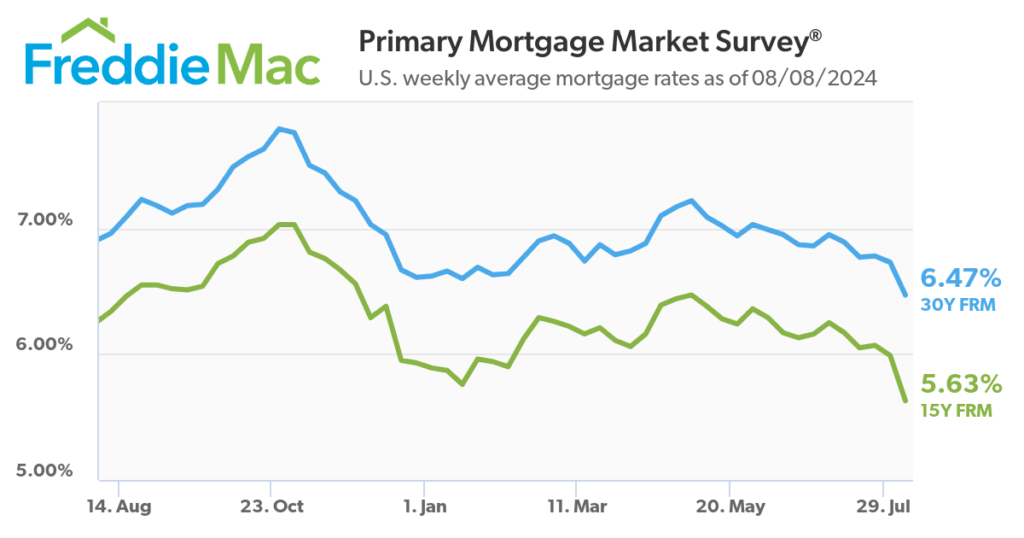

Let’s start with the great news–interest rates have been declining! They now sit around 6.5% and we are hoping to see 6% later this year, which may be as low as they go for a while. This lowers payments and increases affordability for buyers, which is fantastic.

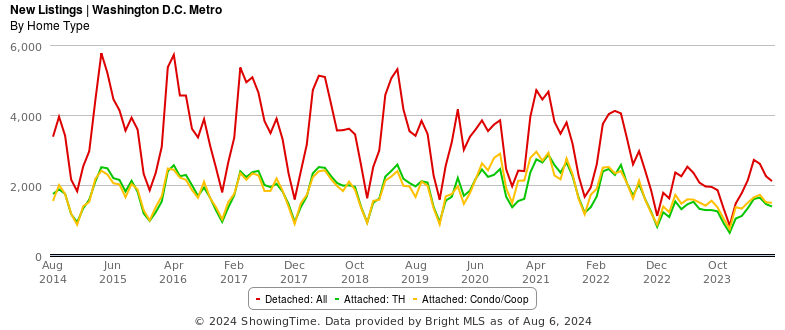

Each year there are seasonal trends in real estate. The largest number of new properties are listed in the spring, and then there are fewer new listings in the summer and fall, and even less in the winter. We are starting to see that summer slowdown happen now.

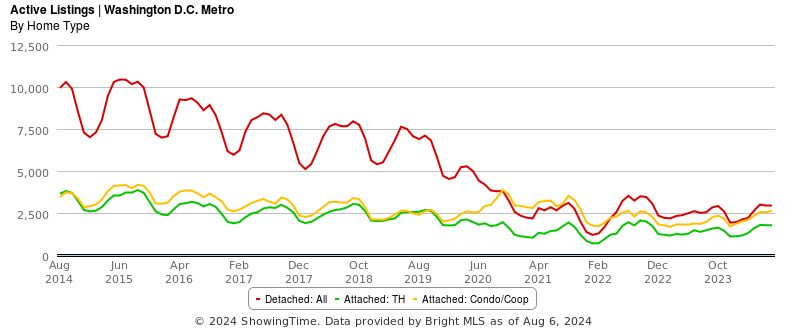

Options for buyers remains tight. The number of active listings is now slightly higher than last year but still well below our 10 year average. We need more inventory to meet demand.

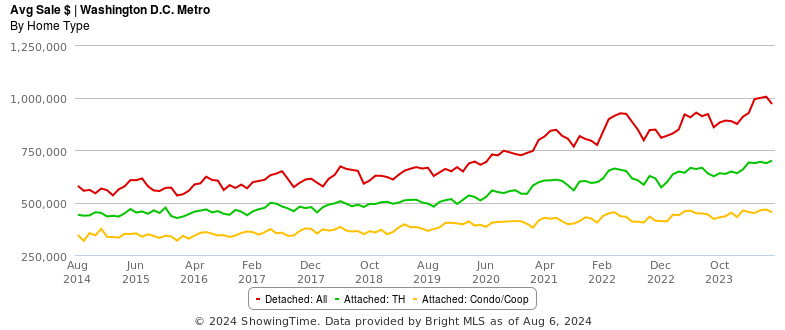

Due to low inventory, home prices continued to rise this year. They appear to have cooled off this month, but that is likely just the typical summer slow down. Right now, throughout the DC metro areas, the average sales price for a single family home is $970,000, $700,000 for townhomes, and $450,000 for condos. Across all home types, average prices are up around 6% compared to this time last year.

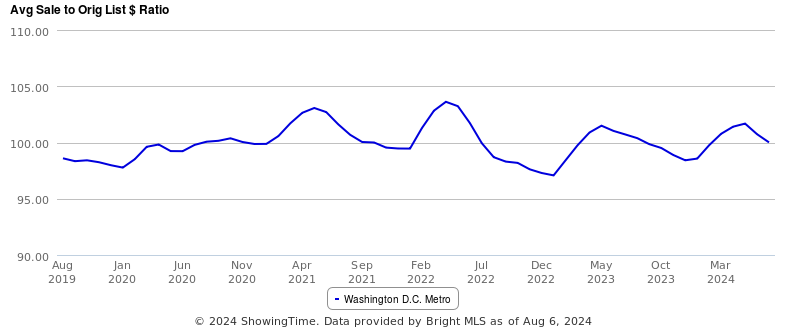

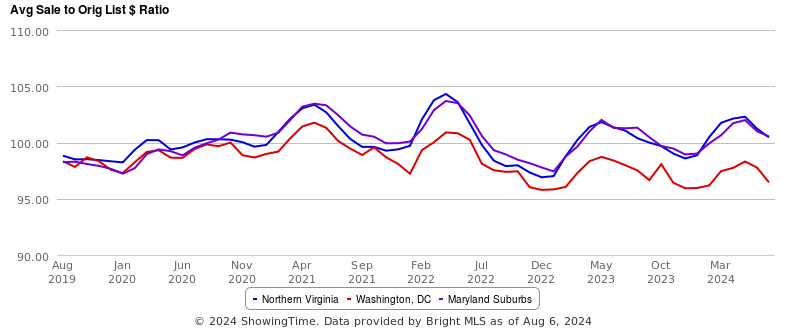

The average “sale to original list price” ratio is back to 100%, meaning that homes are selling on average for their asking price throughout the DC metro area.

HOWEVER, if we extrapolate between DC and the Maryland and Virginia Suburbs, we see that DC homes are selling for around 96% of their asking price, while the suburbs are over 100%.

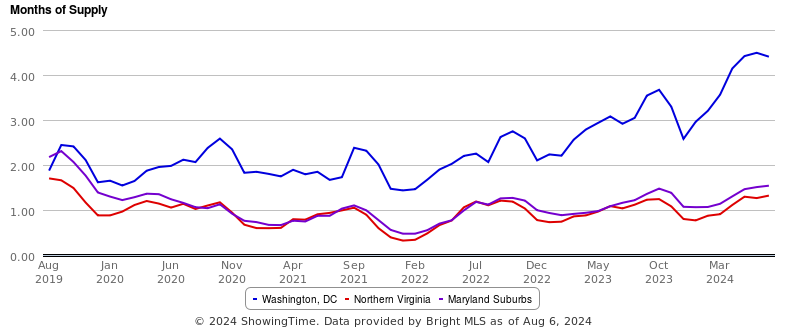

We also see that the months of supply of housing in DC is much higher than the suburbs with VA and MD at 1.5 months of supply and DC over 4 months. The demand for housing is much lower in the District than the suburbs right now.

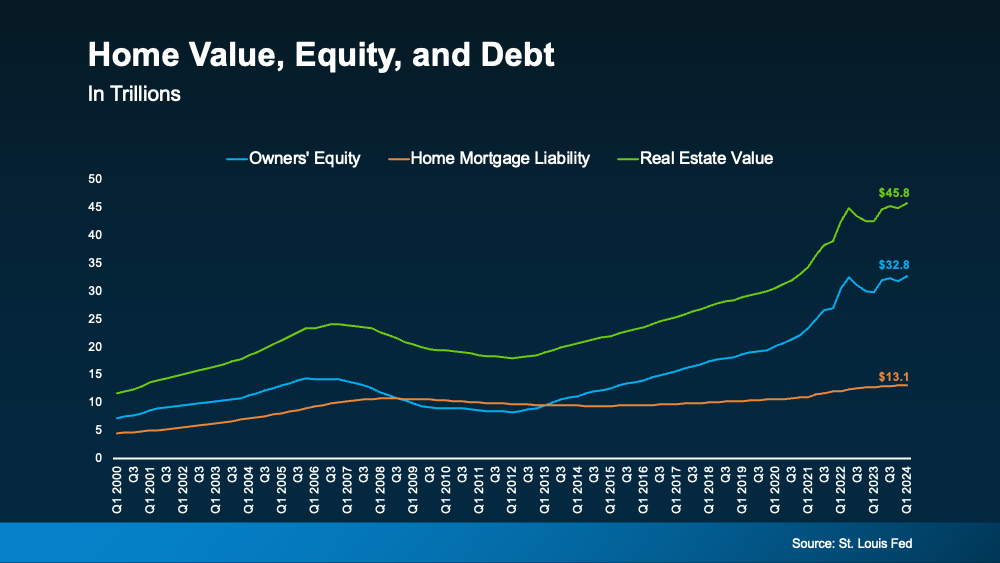

So is real estate still a good investment? If you take a look at this chart showing how the value of real estate compares to the value of owners’ equity and liabilities across the nation since 2000, you can see the strength of today’s real estate market. Since 2000, we have had two recessions but prices have increased nearly 300%. The total value of owned real estate was 11 trillion in 2000 and is now $45.8 trillion. When you consider outstanding loans, we see that homeowners had about $7 trillion in equity in 2000 and now sit at $32.8 trillion. In this market, we’re seeing lots of value, lots of equity, and relatively lower liability of remaining loans. Real estate is still a great investment, and remains a great way to build equity over the long term.

In fact, if you take a look at this dip in interest rates since just a few months ago in April, you’ll see that a $500,000 loan back then would lead to a difference in monthly payment of $375. But if you zoom out and look at the life of the loan, that difference in rates leads to over $135,000 in savings over 30 years. This is quite a huge jump from just a few short months ago, and is great news for sidelined buyers who may have put their home purchase on hold.

So what does it all mean?

If you are a buyer….

- Things are slowly beginning to open up as average sales prices decrease, supply remains steady, and interest rates are trending downwards.

- Right now is a very interesting time for first time buyers or investors looking at condos, which have a high supply versus demand. It could create an opportunity for someone to pick up a first-time home or an investment property this fall, which tends to be when there’s less competition.

If you are a seller….

- You remain in a very good place. While the market is in its seasonal cooling, you might need to be a little more patient. Preparing a home for sale in the right way remains the key to selling for top dollar and it’s important to have a market expert in your corner when valuing your home. If you are thinking of selling we can provide a free, customized home valuation and marketing plan so you know exactly what’s going to happen when, so you’re prepared when the time is right.

That’s it for this month! Please know that you are very important to us. Our goal is to help our clients use real estate to achieve their personal and financial goals, and we are never too busy to take care of you or anybody you care about. We are always here for you and we look forward to speaking with you soon.