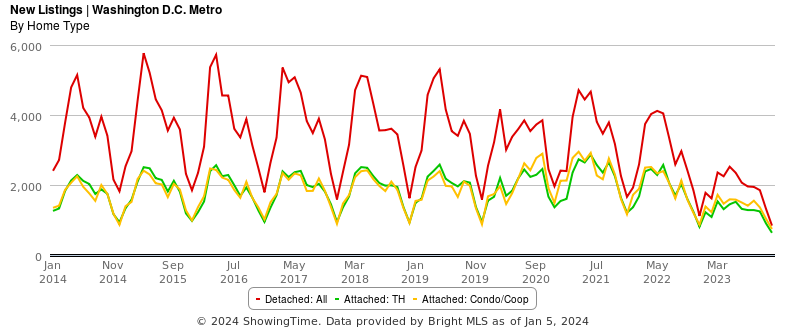

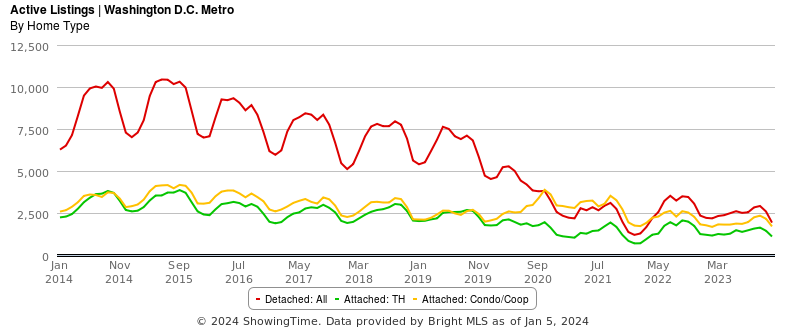

The number of active homes for sale throughout the DC Metro Area decreased in December, which is a typical trend at the end of each year. Single family homes were impacted the most, down nearly 18% compared to this time last year. What’s interesting, which you can see from this ten-year chart, active listings are now near the lowest levels they have been in the past decade!

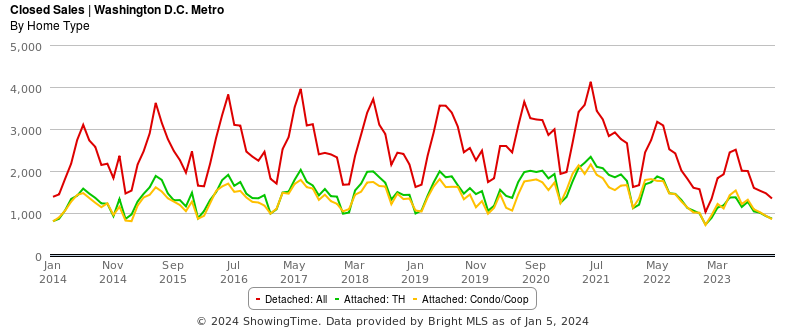

The lack of supply has caused the number of homes sold in December, and really throughout all of 2023, to be far lower than normal. So why was the inventory and sales so low?

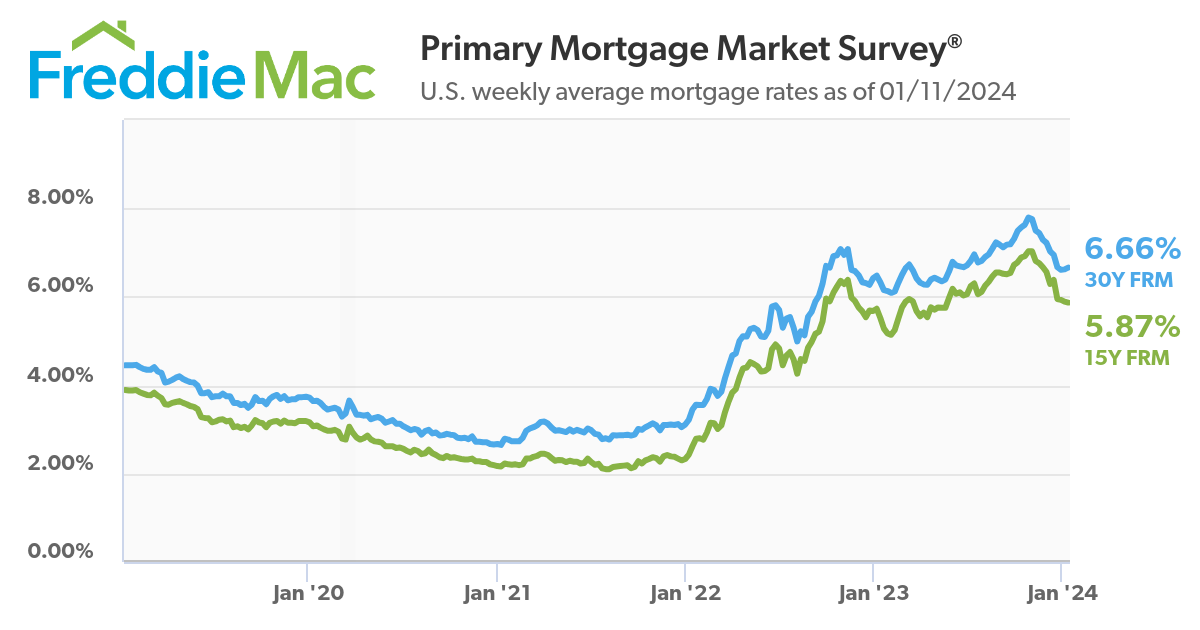

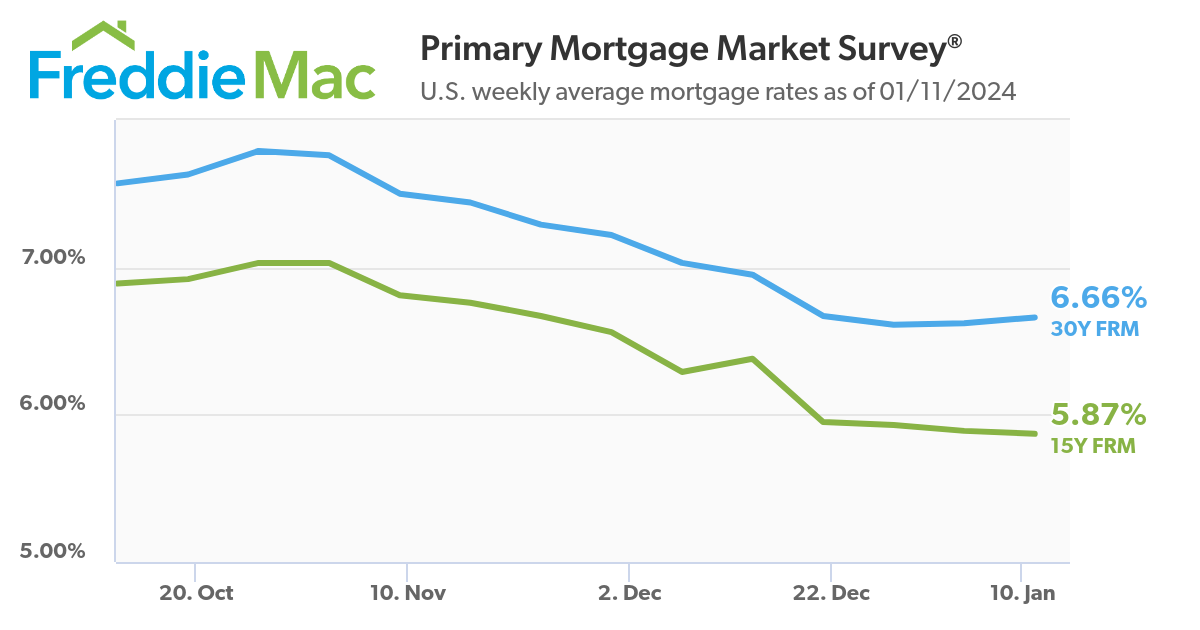

Well, it’s likely because the interest rates that rose from the beginning of 2022 caused buyers to pause their home buying dreams, as increased rates led to increased payments.

The great news for both buyers and sellers is that interest rates have been falling over the past few months, going from a high of around 8 to a current rate of 6.66. This dramatically increases home affordability for buyers and increases buyer demand for sellers.

So… with low inventory and low sales, what did that mean for home prices?

The great news for homeowners is that home prices have held steady even with these low sales and high interest rates. In fact, prices are up around 10% across all home types compared to this time last year, giving us all the more confidence in the DC Metro Area being a great place to invest in real estate.

So what does the future hold? Will inventory rise? Well, according to the New Listings chart here, the amount of new homes on the market remained very low. So, the predictions are that inventory will remain tight in the near future and prices should remain steady, if not rising.

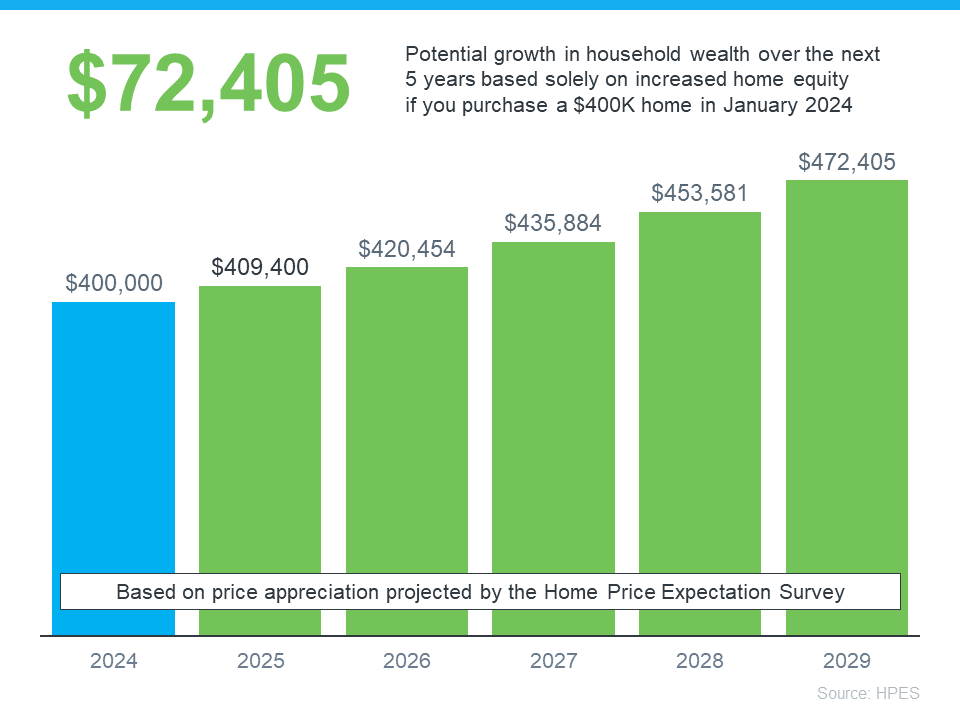

In other good news, a survey of 100 of the top economists in the US shows that they predict home prices will rise over the next 5 years. Based on their predictions, if you purchased a $400,000 home in January 2024, they could expect your home to be worth $472,000 in 2029, raising your net worth by over $70,000 just through increased home equity alone.

So what does it all mean?

If you are a buyer….

- The market remains tight, but inventory rises each month through June so more options are on their way.

- If you are waiting to start the buying process until interest rates or prices dip, you’re not alone. But, you may have two problems. First, given the low number of homes available, I don’t think we will see prices fall in the near term–and if interest rates do fall, demand will increase causing prices to rise even more.

- At this point, if you want to buy, I recommend you get preapproved by a great lender, start looking, and be patient. It may take some time, but you need to be ready to move quickly when the right house comes on the market.

If you are a seller….

- Prices are high and inventory is low, so you are in a great position. Now is the time to get every dollar you can for your home and we can help you do that.

- Now if you’re selling and buying, you’ll need to consult an expert Realtor you can trust to ensure you’re protected because you need to roll the money from your first home to your new one. The process is a bit more complicated, and you work too hard to take a risk with one of your biggest investments.

No matter where you are in your homeowning journey, give us a call. We’re here for you, we care about you, and we want to serve you.